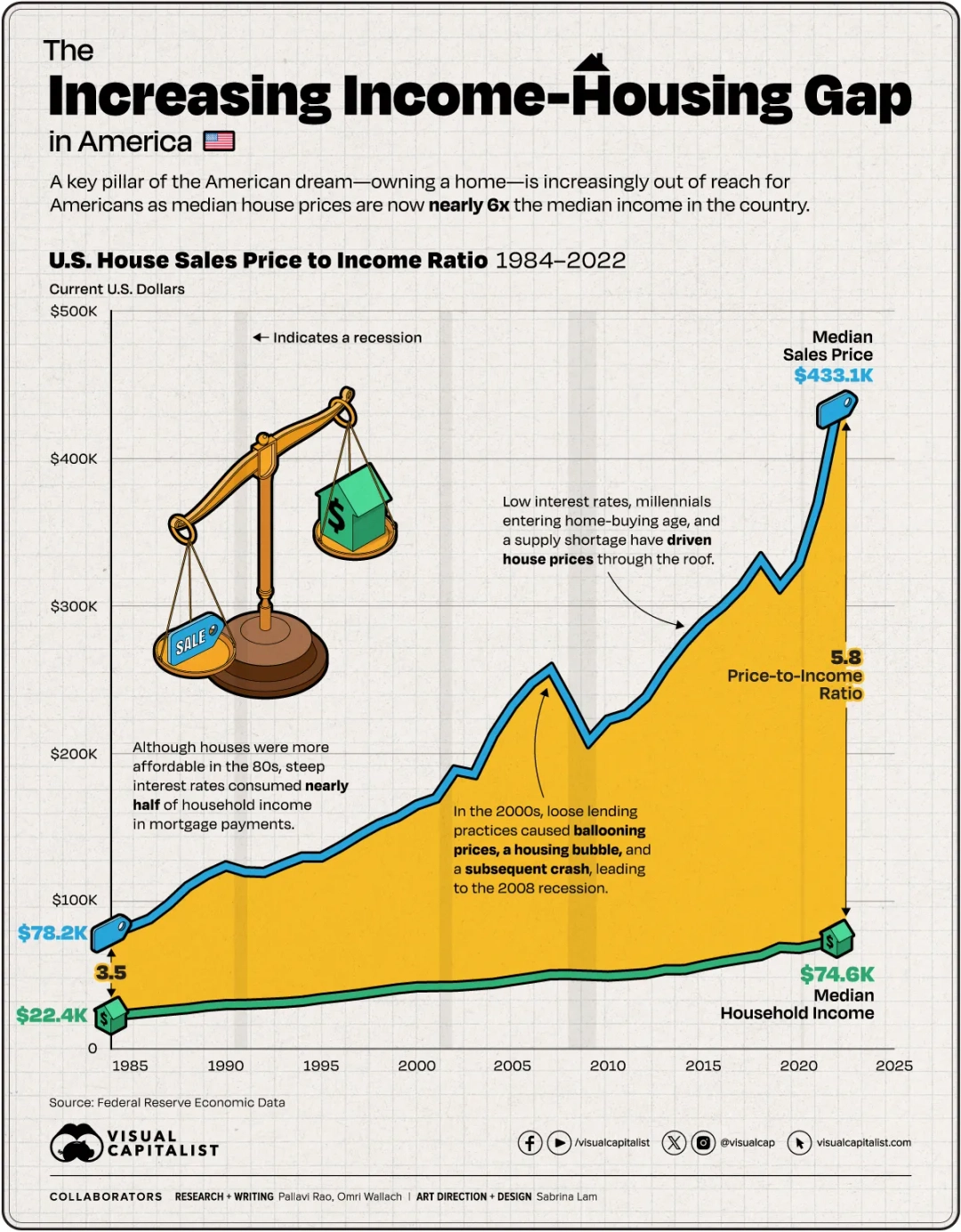

I think it is important to consider that while it’s clear the next generation will not realize the American Dream in the same way as their parents and grandparents did, we are still thriving if you look back just a little further.

Housing, the work environment, modern transportation, and modern healthcare are all infinitely better compared to 100 years ago. The working poor in America live better than kings 500 years ago.

We live in America and there is currently an optimism about the future. Recent polls show that for the first time in a long time, most Americans are optimistic about the future.

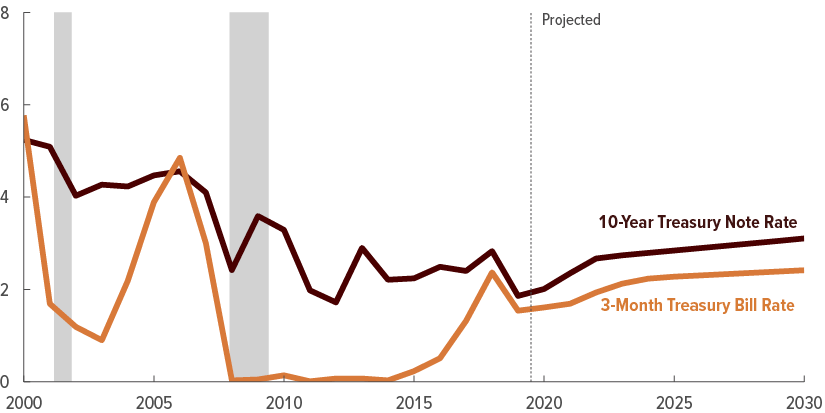

My advice to first time homebuyers is the same as what I told my daughter and son-in-law who purchased a home last year. Buy a home with income producing capability to cover the higher cost or buy a fixer upper and start building equity.

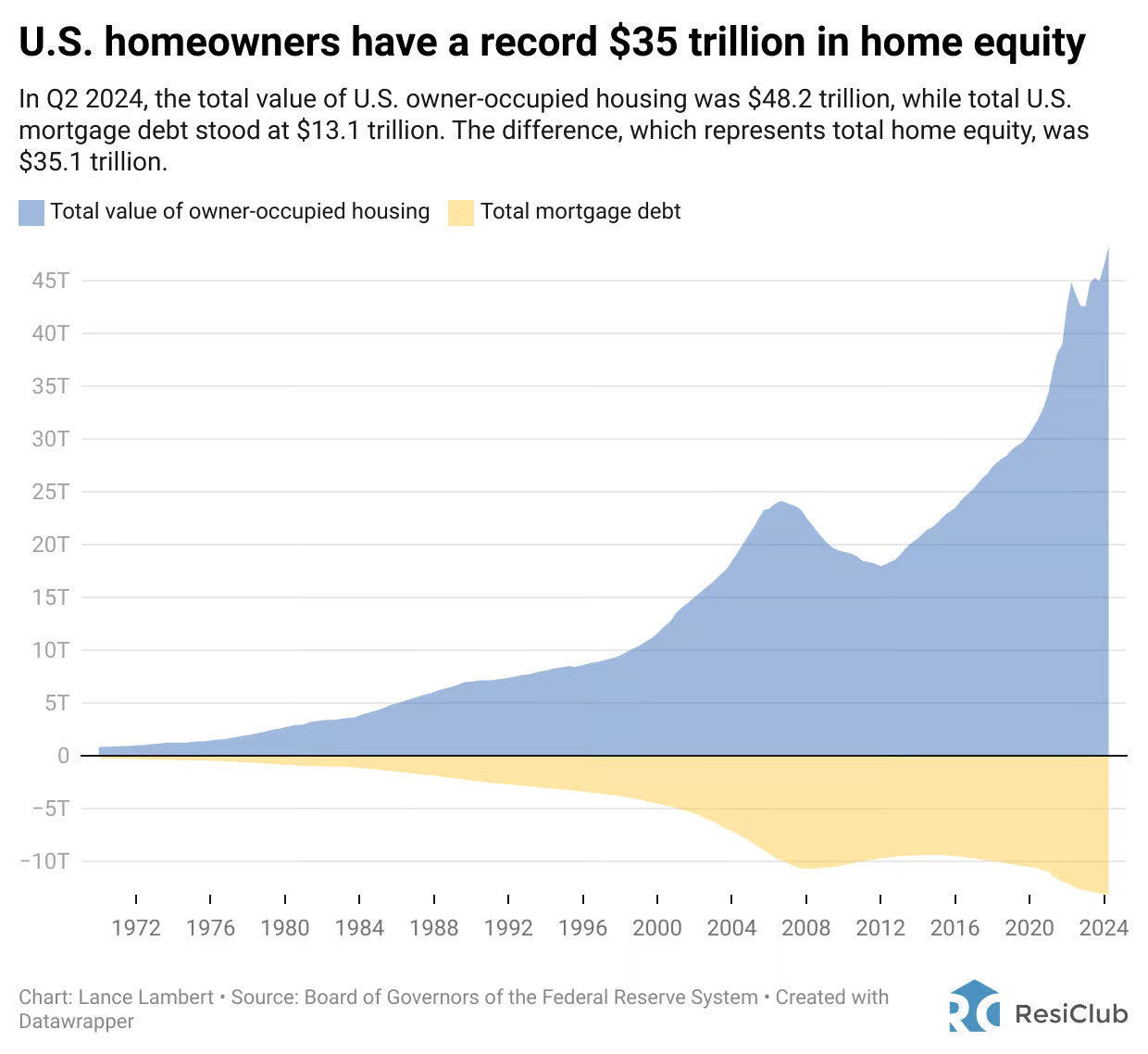

The fact of the matter is owning a home is still the #1 way for Americans to build wealth and long term financial security, that hasn’t changed. Thank you for coming to my Ted Talk!